WHEN ANCIENT MEETS AVANT-GARDE

The Convergence of Islamic Finance and ESG Investing

Misconceptions about the Environmental, Social and Governance (“ESG”) may mislead you to believe that it merely duplicates Islamic Finance. In truth, both investment approaches are like the proverbial two sides of a coin; inasmuch as they are separate and distinct from each other, they also share similar characteristics of sustainable and responsible investing (“SRI”). Whereas ESG investing primarily considers what is allowed, Islamic Finance diverges from what is prohibited, but both financing modes point to the same goals of stewardship.

ESG encompasses sustainable investments related to environmental and social stewardship, supported by good governance, while Islamic Finance focuses on the stewardship of life itself, in compliance with the Shari’ah law. The Islamic legal system forbids certain money-making schemes such as speculative investments (“gharar”), investing in prohibited (“haram”) activities, such as gambling and selling alcoholic drinks, and pursuing exploitative gains, such as generating interest income from loans (“riba”).

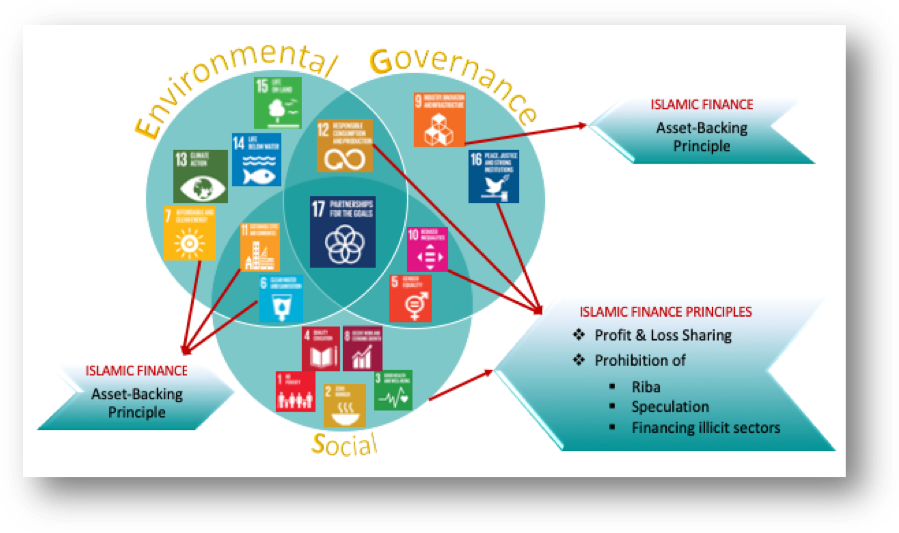

ESG principles direct the investment focus on the sustainability framework referred to as the triple bottom-line, wherein business performance is evaluated not only based on net profit but, more importantly, on the positive and negative impacts on people and planet. In essence, this value creation strategy aligns with the 17 Sustainable Development Goals (“SDGs”), the universal policy agenda which was officially adopted by the 193 member states of the United Nations in September 2015. When viewed from the lens of the SDGs, the convergence of the 1,600-year-old principles of Islamic Finance and the 21st century ESG investing principles becomes much clearer.

What is the best way to appreciate the close correlation between ESG and Shari’ah principles against the backdrop of the SDGs? Start by examining the social component of ESG which consists of goals that benefit society, such as poverty and hunger eradication, healthcare, education and decent employment. Next, compare this with the Shari’ah principles of profit and loss sharing. You will find that both principles point to the overarching goal of leaving no one behind in the pursuit of global development.

Similarly, you will also discover that the Islamic Finance rule of asset-based investment actually corresponds to the environmental goal of affordable clean energy (“SDG 7”) and the goal of industry, innovation and infrastructure (“SDG 9”) that is germane to corporate governance. There is no competition between ESG investing and Islamic Finance. Instead, they complement each other as fund-raising mechanisms that companies can utilise to pursue their commitments to contribute to the achievement of the global sustainable development goals.