[Bursa Malaysia Sustainability Disclosure Listing Requirements]

More than just a fleeting buzzword, Sustainability has been catapulted as a business imperative for Public Listed Companies (“PLCs”) in Malaysia since May 2015 when Bursa Malaysia signed the voluntary commitment of the Sustainable Stock Exchange (“SSE”) to promote environmental, social and governance (“ESG”) performance in capital markets.

The SSE is a United Nations Partnership Programme jointly organised by four UN agencies namely (1) the United Nations Conference on Trade and Development (“UNCTAD”), (2) the United Nations Environmental Programme Finance Initiative (“UNEP FI”), (3) the Principles for Responsible Investment (“PRI”) and (4) the UN Global Compact. Launched in New York in 2009, the SSE initiative provides a peer-to-peer learning platform for stock exchanges to collaborate with investors, regulators and listed companies in advancing corporate transparency and performance relating to ESG matters as a means to encourage sustainable investment.

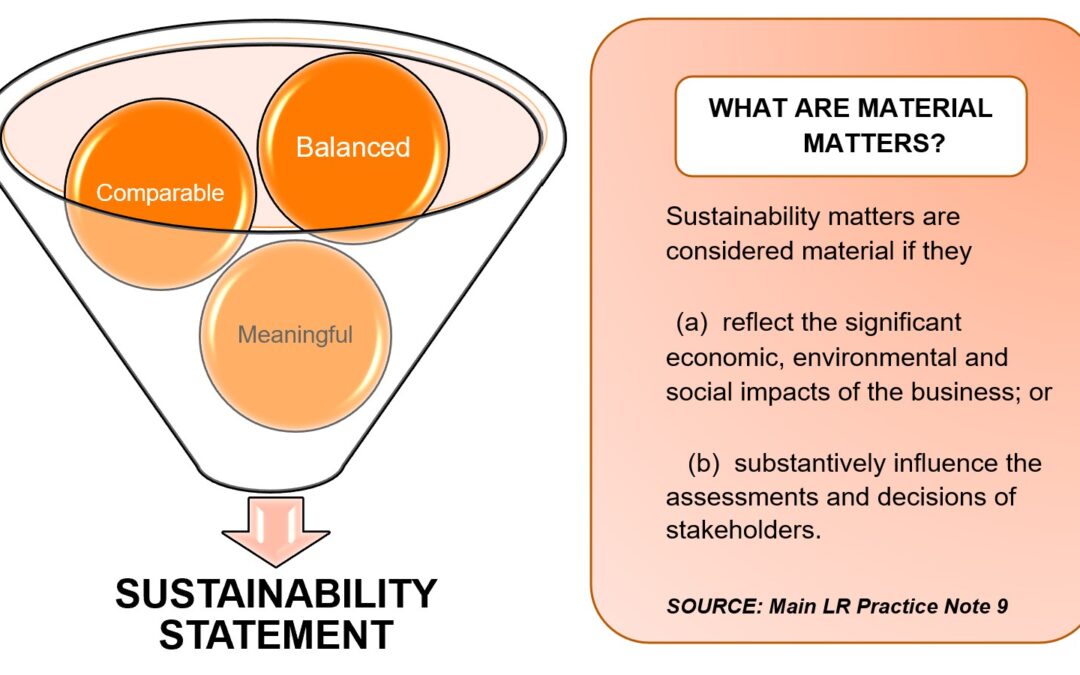

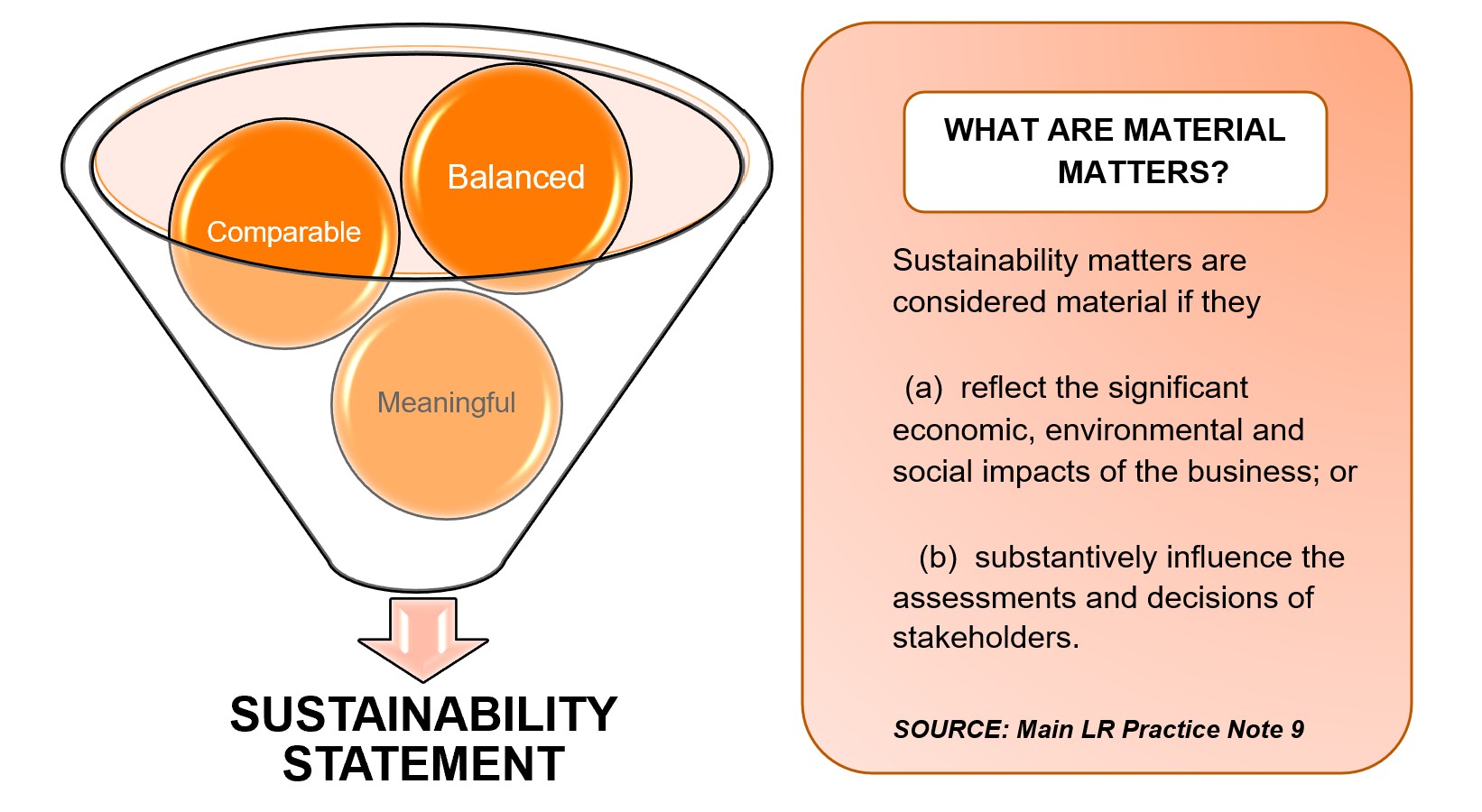

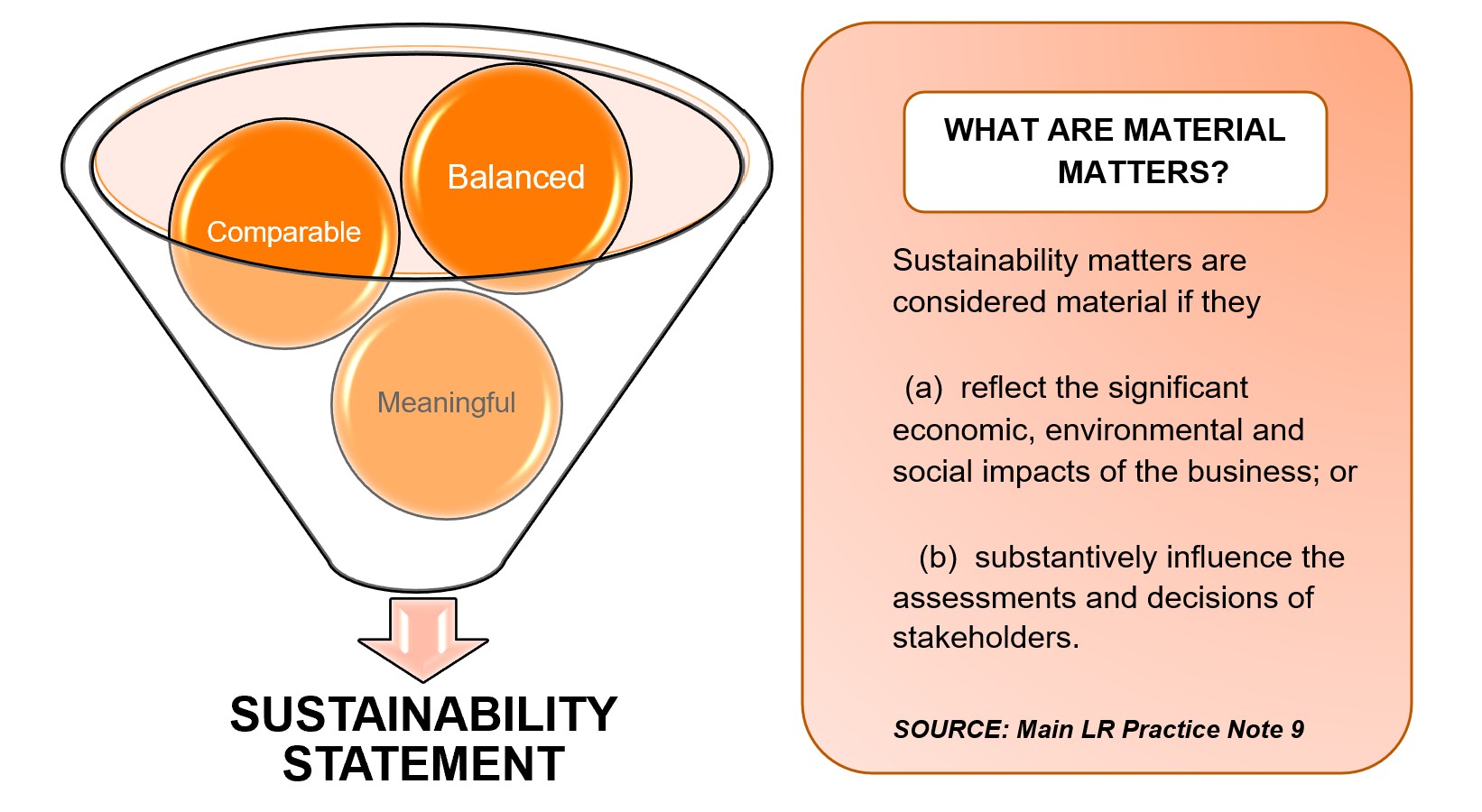

As an SSE Partner Exchange, the Bourse needed to introduce some changes to its Main Market Listing Requirements (“Main LR”) in October 2015. The amendments of the Main LR’s Practice Note 9 (Risk Management and Internal Control, Corporate Governance and Sustainability Statement) entail that all PLCs in Malaysia must include a Sustainability Statement with disclosures on the management of material economic, environmental and social (“EES”) risks and opportunities in their annual reports. PLCs are encouraged to utilise the Exchange’s Sustainability Reporting Guide as a point of reference, particularly in identifying the material EES risks and opportunities (material matters). Moreover, the Sustainability Statement must contain balanced, comparable and meaningful information.

Replacing the previous requirement of the Corporate Social Responsibility (“CSR”) statement, the Sustainability Statement must contain the following disclosures:

- Governance Structure to manage the EES risks and opportunities

- Scope of the Sustainability Statement and basis for the scope

- Material Sustainability Matters with explanation on why the topics are material or important to the PLC’s business, how they were identified and managed, including details on

- Policies to manage the material matters

- Measures or actions taken

- Relevant indicators demonstrating performance in managing the sustainability matters

PLCs are still required to continue reporting on their CSR activities or practices, or a statement signifying the absence of such activities. The predominant practice is to report the CSR initiatives under the Social component of the Sustainability Statement.

Updated as at 19 January 2022, Practice Note 9 allows PLCs the flexibility of preparing the Statement in accordance with the Global Reporting Initiative (“GRI”) Sustainability Reporting Guidelines, in which case they do not need to comply with the Main LR’s disclosure requirements.

Operating as the ESG performance report card, a data-driven and science-based Sustainability Statement can prove daunting and time consuming to produce. Unless the PLC has a dedicated Sustainability or ESG team, it would make more sense to outsource this gargantuan task to a competent consulting firm to ensure that the report is compliant with Bursa Malaysia’s requirements. Taking this option enables PLCs to focus on their core business while delivering on their ESG commitments leading to the achievement of the global sustainability agenda.