Towards a Common Goal

Developing a Strategic Stakeholder Engagement Plan

“If you want to go fast, travel alone; if you want to go far, travel together,” according to a famous African relationship quote. Business leaders understand that nurturing strong relationships with stakeholders through effective communication is essential for long term success.

Critical to an organisation’s Strategic Plan, a Stakeholder Engagement Plan can bolster collaborations between the business and stakeholders because it uncovers value-added benefits for both parties, such as:

Who are Your Stakeholders?

Broadly classified into two categories, your stakeholders are those who have an interest in or influence over the organisation.

- Internal Stakeholders: People who are part of the company such as the Board of Directors, Management and Employees

- External Stakeholders: Entities who are impacted by all acts and outcomes of the business operations, such as suppliers, government regulators, customers and communities

Managing Stakeholder Engagement Plan

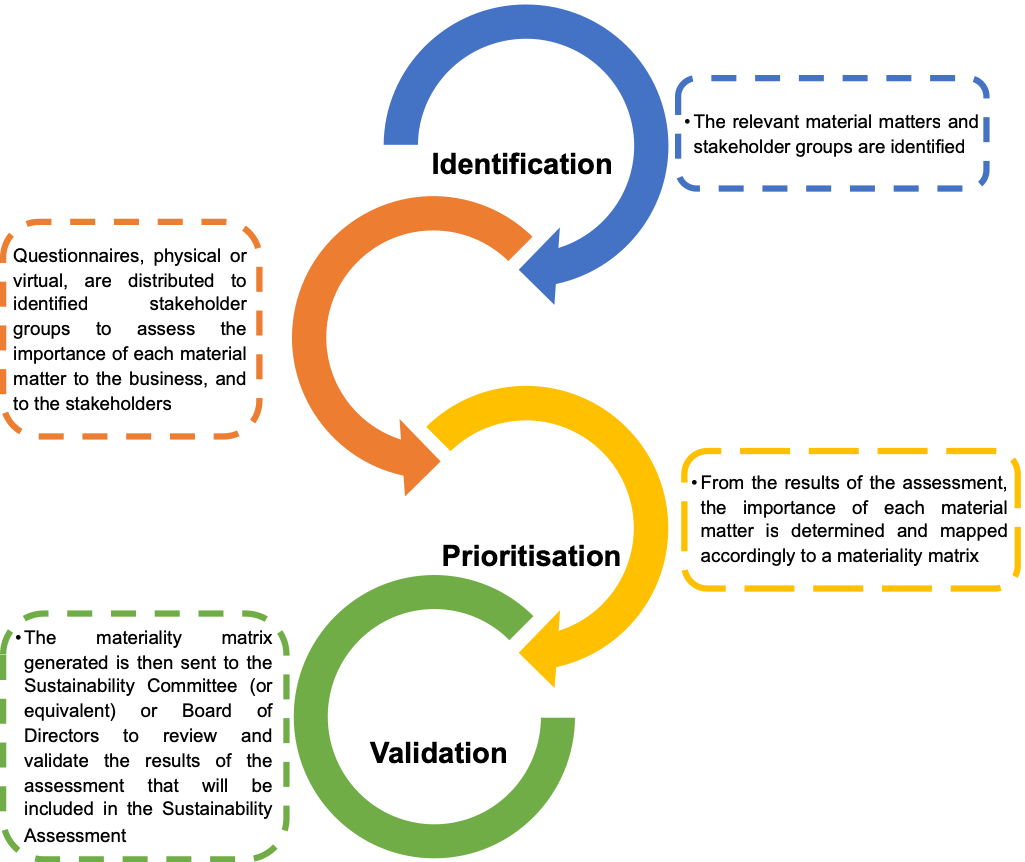

With the availability of online tools, creating and managing a two-way communication mechanism with various stakeholder groups have become simpler and more efficient, especially when you follow a logical process. For businesses who have embarked into a sustainability journey, here’s what has worked so far:

Step 1: Identification of Stakeholder Group

The first step to stakeholder management is to identify and establish a stakeholder list. The main point is to be as comprehensive as possible so as not to overlook any important stakeholders. Upon completion, the list can be divided into different stakeholder groups for ease of analysis.

Step 2: Stakeholder Analysis and Mapping

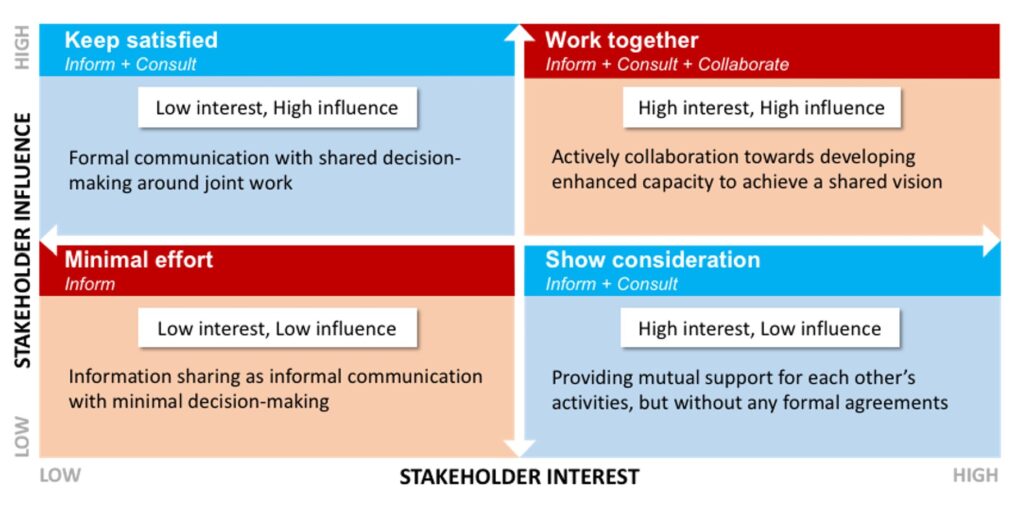

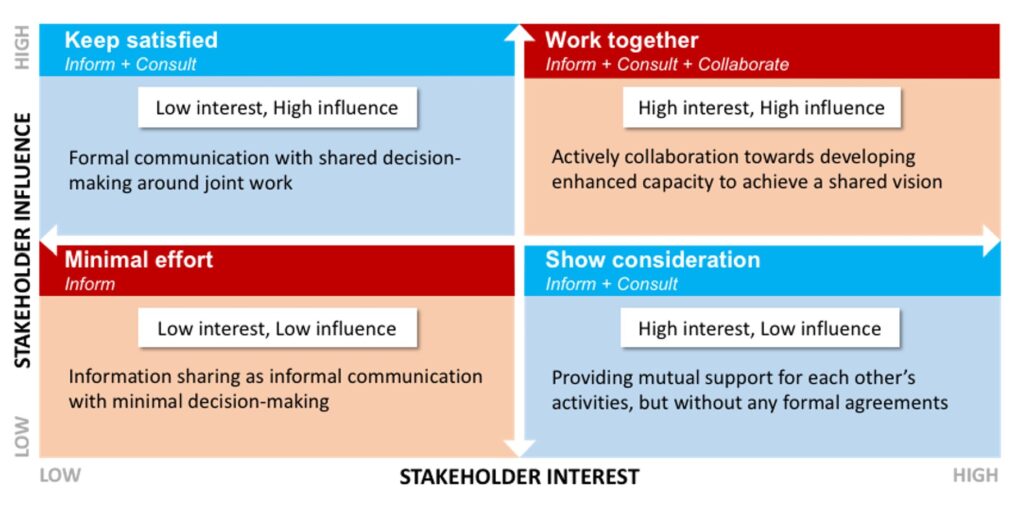

The stakeholder groups can be visualised on the matrix below based on:

- Their level of influence over the organisation

- Their level of interest for the organisation

Step 3: Clarity of Purpose

To be effective, your Stakeholders Engagement Plan must include the coherent purpose of addressing the concerns and expectations of your stakeholders depending on the following elements:

- Business Sector

- Resource Allocation

- Stakeholder Engagement Roles

Step 4: Building your engagement strategy

From the stakeholder analysis and engagement purpose, you can formulate a strategy that serves as a blueprint for when and how to communicate with your stakeholders. Your goal is to transmit, with maximum efficacy, relevant information in a transparent manner at the most appropriate time.

The figure below illustrates the prioritisation of communication methods based on the importance of stakeholders:

As an essential prerequisite in Sustainability Reporting, undertaking a Stakeholder Engagement exercise provides a clear path towards managing stakeholder concerns in an appropriate manner. It also demonstrates your organisation’s commitment to be consistently transparent and accountable to your stakeholders as you work together in the pursuit of common goals.

One PLC that has benefited from an SLL facility is “Ajinomoto (Malaysia) Berhad (“AMB”). In December 2020, the Japanese multinational food additive manufacturer entered into a RM100 million Sustainability-Linked Islamic Financing Agreement with MUFG Bank (Malaysia) Berhad (‘MUFG’). Demonstrating its status as a responsible steward of the environment, AMB has embarked into an environmentally-friendly industrial development with the construction of a manufacturing plant at the Techpark@Enstek in Negeri Sembilan. With the provision of MUFG’s SLL facility to finance its capital expenditures, AMB commits to reducing its greenhouse gas (GHG) emissions by 30% from the financial year ended 31 March 2019 to the financial year ended 31 March 2026.

One PLC that has benefited from an SLL facility is “Ajinomoto (Malaysia) Berhad (“AMB”). In December 2020, the Japanese multinational food additive manufacturer entered into a RM100 million Sustainability-Linked Islamic Financing Agreement with MUFG Bank (Malaysia) Berhad (‘MUFG’). Demonstrating its status as a responsible steward of the environment, AMB has embarked into an environmentally-friendly industrial development with the construction of a manufacturing plant at the Techpark@Enstek in Negeri Sembilan. With the provision of MUFG’s SLL facility to finance its capital expenditures, AMB commits to reducing its greenhouse gas (GHG) emissions by 30% from the financial year ended 31 March 2019 to the financial year ended 31 March 2026.